Whenever someone plans to purchase a property, the biggest question on their mind is: “Is this property genuine and is the owner the same as the one selling it?” Most property disputes in India arise due to document errors or fraud. Therefore, it becomes crucial to thoroughly verify the title, registry, and ownership documents.

Failing to do so could lead to serious problems in the future, such as legal disputes, disputes over possession, or property claims. Therefore, it is wise to carefully examine all legal documents before investing in any property.

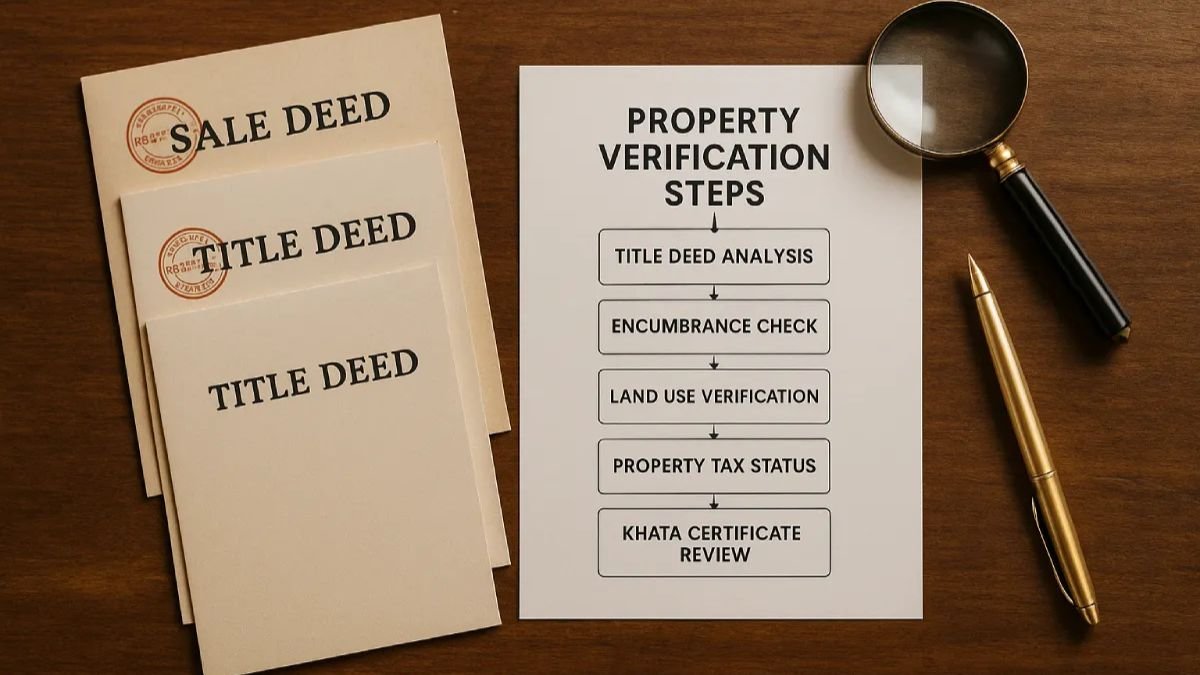

What is a Title Deed and How to Verify It

A title deed is a document that proves the true owner of a property. It is also called a “sale deed” or “ownership deed.” The title deed contains the owner’s name, complete property details, measurements, location, and date of purchase.

To verify this document, first, check whether the title deed is original or a photocopy. Only original documents are considered valid. Second, ensure that the deed has been registered with the relevant sub-registrar office.

You can also verify the title deed with the local tehsil or municipal corporation office. If a property already has a loan or mortgage, it will also be mentioned in the title deed. It is important to ensure that there are no legal encumbrances or claims on the property.

The Importance of Checking Registry Documents

Registry documents are the process by which the purchase or transfer of property is recorded in government records. When you purchase a property, both the seller and the buyer must go to the sub-registrar office to register the deed.

To verify the registry, you can visit the sub-registrar office to see if the property is registered in your name. In today’s digital age, many states have made their land records available online. For example, through the ‘Bhoolekh’ (land records) in Uttar Pradesh, the ‘Mahabhulekh’ (land records) in Maharashtra, and the ‘DLRC Portal’ in Delhi, you can check the registry status online.

The registry document should also ensure that the area and boundaries of the land or house match the land you wish to purchase. If there is a discrepancy between the registry and the actual property, it could lead to future disputes.

How to Verify Ownership

Verifying ownership is a crucial step. Sometimes, the person selling the property is not the actual owner or is trying to sell a property registered in someone else’s name. Caution is crucial in this situation.

Compare both the title deed and the registry to identify the property owner. Also, check for copies of utility bills, such as electricity bills, water bills, or property tax receipts, that the owner has. These documents prove that they are in actual possession of the property.

If the property is in the name of a trust, company, or joint family, also check that permission has been obtained from all relevant parties. No property can be legally sold without the consent of all owners.

Checking the Encumbrance Certificate

An Encumbrance Certificate (EC) is a document that states that there are no loans, mortgages, or legal obligations on the property. This certificate can be obtained from the local registry office.

When purchasing a property, it is best to obtain encumbrance records for 13 to 30 years. This will give you clear information about whether there are any bank loans or prior ownership claims on the property.

If the property was purchased on bank finance, the bank’s name and loan details will be recorded. Purchasing a property without reviewing the Encumbrance Certificate can be risky.

Verify Land Records and Maps

To verify the authenticity of any property, check land records, such as “Jamabandi,” “Khasra,” and “Khatauni.” These documents can be obtained from the local tehsil or online land records portal.

Seek assistance from the local Patwari or Survey Officer to verify the land map and boundaries. This helps determine whether the geographical location of the property matches government records.

Fraudsters often sell land that is actually government or disputed. Therefore, verifying land records should be the first step.

Check for Proof of Stamp Duty and Tax Payment

Whenever a property is bought or sold, stamp duty and registration fees must be paid to the government. This amount serves as proof that the transaction has been legally registered.

The property documents should be checked to ensure that stamp duty and taxes have been paid. Many times, to avoid paying taxes, people make deals based on incomplete documents, which may later prove to be illegal.

Check for legal restrictions or court cases on the property

Before purchasing, it is very important to know if there are any legal restrictions or court cases on the property. You can check with your local court or online judicial records for this.

If the property is embroiled in a dispute, it is not safe to buy it. In such cases, a long court case may arise.

Conclusion: Caution is the key to safety

Buying property is a major investment in anyone’s life. A small mistake or negligence can cause problems for years. Therefore, never underestimate the importance of verifying the property’s title, registry, and ownership documents.

By verifying the correct documents, legal verification, and expert advice, you can not only avoid fraud but also protect your investment. Remember, due diligence before investing in a property is your greatest protection.